Know Your Business

Accelerate Business Verification with Accuracy and Confidence

- Accurate UBO Identification

- Global Business Registry Access

- Cross-border Entity Screening

- Risk Tier Classification

- Adverse Media Checks

No real-time monitoring

Data is gathered and reviewed manually

Hard to navigate and problematic systems

Hidden fees and complex onboarding processes

Infrequent update of Watchlist Databases

Lack of API integration

Limited Coverage

Dated systems with inadequate filtering capabilities

Real-time risk monitoring

Watchlist Database created using Machine Learning and AI

Intuitive and accessible web interface

Transparent pricing with no hidden costs

Database is updated daily

Unlimited multi-user access at no additional cost

API integration capabilities

Global coverage of PEP/Sanctions and Adverse Media

Intelligent filters to reduce false positives

Looking for Fraud Prevention Solutions?

With over 30 years of experience in Payment Fraud Prevention, GPayments has committed itself to developing solutions that are globally interoperable and built on industry standards.

Reduce Fraud & False Declines

Protect your business and customers with ActiveServer 3DS Server: advanced authentication, real-time fraud detection, minimising chargebacks and false declines, ensuring secure shopping, and fostering trust.

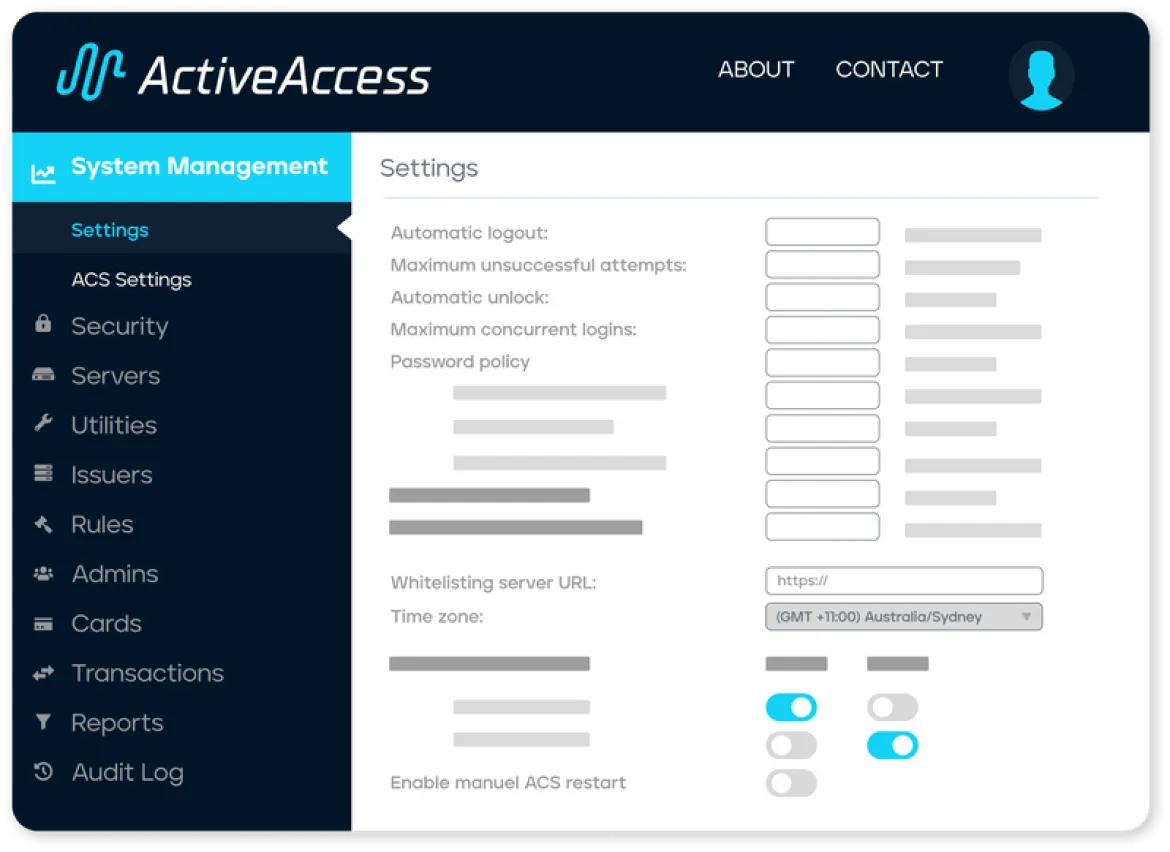

Reduce False Declines and Drive Growth

Boost cardholder protection and transaction growth with ActiveAccess: secure shopping, trust-building ACS platform. Maximise revenue, user experience, and loyalty. Elevate your business with ActiveAccess.

Streamline Your 3D Secure Testing

Realistic 3D Secure Testing: Live components for accurate results. TestLabs offers ActiveServer, ActiveAccess, Directory Server, and custom test cases. Ensure reliable and secure 3DS implementation.